2024.4.26

Event Report

Our association works to cultivate the angel investment environment in Japan and support the growth of startups. We aim to disseminate various information related to angel investment, including activity reports, latest news, and event summaries, on a monthly basis.

In December 2023, our director, Toshiyuki Yamamoto, participated as a panelist in the “Startup Grind Tokyo End of 2023 Party” held in Tokyo. This event marked the first offline gathering of Startup Grind in Tokyo, the largest startup ecosystem originating from Silicon Valley. Amidst the vibrant atmosphere where global-minded startups, investors, and supporters converged, we will highlight the aspects related to angel investment and provide a report.

Yamamoto:Startup Grind is the world’s largest startup community, with over 500 chapters in 125 countries and a membership of over 5 million people. Hosting its first offline event in Tokyo, I could sense the determination of the organizers.

The theme of the event, as well as both the speakers and participants, were all geared towards a ‘global’ mindset.”

“The individuals I spoke with were all globally minded, involved in businesses targeting overseas markets, belonging to international investor associations, or connected with foreign organizations. It’s remarkable how the concept of ‘startup’ and ‘global’ has become ubiquitous.

When I first visited Silicon Valley 12 years ago with the determination that ‘Japan should also go global!’, people would often ask, ‘What’s a startup?’ But nowadays, everyone is talking about startups and going global.

We receive inquiries every day at our association along the lines of ‘We’re targeting overseas markets for investment’ or ‘Inviting participation in international investment communities for idea exchange.’ The times have truly changed, and I felt that the Startup Grind Tokyo event perfectly aligns with the current trend.

From left to right: Mr. Honjo, Mr. Ishii, Mr. Yamamoto, Mr. Morimoto

Mr. Yamamoto, our director, participated as a panelist in the panel discussion on angel investment. The other three panelists were Mr. Ishii, Mr. Morimoto, and Mr. Honjo, with Mr. Shuji Motohashi serving as the moderator.

Mr. Yoshiake Ishii (Councilor, Cabinet Office, Ministry of Economy, Trade and Industry / Reviewer, Fund Business Division, Independent Administrative Agency, Small and Medium Enterprise Agency)

Ms. Chigako Morimoto (CEO, Morich Co., Ltd. / AllRounderAgent)

Mr. Toshiyuki Yamamoto (Representative Director, Japan Angel Investors Association)

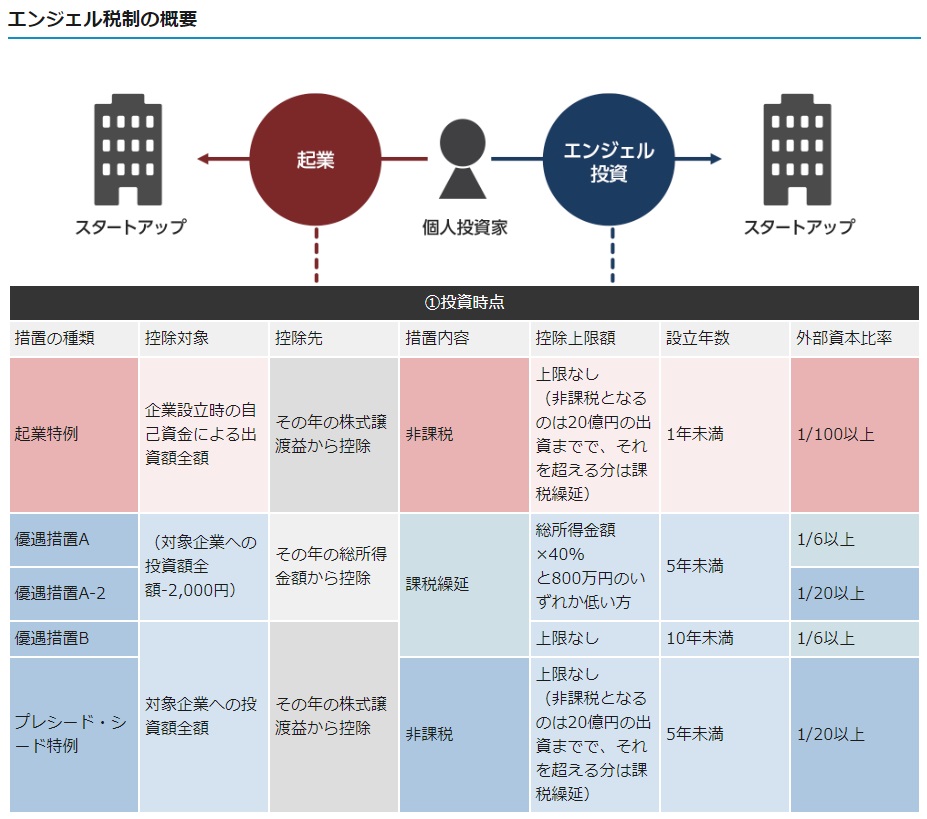

Mr. Ishii from the Ministry of Economy, Trade and Industry explained the revised points of the “angel tax system,” which is a beneficial scheme for both startups and individual investors. The system was expanded in the revision of Reiwa 5, and Reiwa 6 further enhances its convenience.

The most significant revision is that the new share subscription rights (J-KISS) have been included in the scope of the angel tax system.

*J-KISS* is a simple fundraising method using new share subscription rights, mainly used for fundraising during the seed stage.

The call for “including new share subscription rights in the tax incentives” was quite widespread, but providing tax incentives for something other than common shares was challenging, which took time. With this revision, new share subscription rights, which were previously completely excluded, will be eligible for tax incentives starting from the fiscal year in which they become common shares, albeit with some delay.

Indeed, this is likely very welcome news for both startups seeking funding and angel investors.

Here’s a brief summary of the Angel Tax Incentive:

1. **Startup Special Treatment**: The entire amount of self-capital investment at the time of company establishment is tax-exempt. However, investment exceeding 2 billion yen is subject to deferred taxation.

2. **Incentive Measure A**: The amount deducted from the total investment in eligible companies, minus 2,000 yen, is deducted from the total income amount. The deduction limit is the lower of 40% of the total income amount or 8 million yen.

3. **Incentive Measure A-2**: The entire amount of investment in eligible companies is tax-exempt. (No upper limit)

4. **Incentive Measure B**: The entire amount of investment in eligible companies is deductible from capital gains on stock transfers. (No upper limit)

5. **Pre-Seed/Seed Special Treatment**: Tax-exempt with no upper limit.

From the Ministry of Economy, Trade and Industry website

Furthermore, losses from the sale of unlisted startup shares can be offset not only against other stock transfer gains for the year but also carried forward for up to three years to offset subsequent stock transfer gains.

山本理事 shared insights on how to identify promising startups as an angel investor. He emphasized the importance of having a keen eye for startups, which is crucial in making investment decisions. He elaborated on this topic in detail in his book titled “Angel Investor’s Practical Bible: Entrepreneurs You Should Definitely Invest In, and Entrepreneurs You Should Not,” which was published on March 21st.

Additionally, there was discussion about the potential expansion of various industries through legal reforms. Looking ahead, the Japan Angel Investor Association aims to actively engage in advocacy for legislative reforms to support the industry’s growth.

Yamamoto: Japan still adheres to regulations made decades ago without adjusting to the changing times. There are many industries, like the electric kick scooter “LUUP,” where the blue ocean expands through legal changes.

In the caregiving industry, despite the advancement of digital transformation (DX), they’re still operating under rules set in the Showa era, even though fewer people are needed. Similarly, in the beauty industry, there’s a severe shortage of manpower, yet we still have situations like the “Sazae-san haircut” being a graduation requirement! Nobody wears that hairstyle anymore, but students are spending their precious youth practicing the Sazae-san cut. (laughs)

Starting a business with a view toward legal reform is something I believe should begin during the seed stage. If a company can achieve legal reform upon going public, it can change dramatically all at once.

We, as an association, will fully support such endeavors.

How to support startups

“Startup 5-Year Plans” and similar initiatives demonstrate a concerted effort by the government to support startups, but we shouldn’t view them as temporary measures. Looking ahead, what should be the future of startup support?

Yamamoto: Compared to a decade ago, there’s a significant effort from various quarters to support startups, and I feel that now we have sufficient weapons and environments to compete effectively. Startups, by nature, have to strive and rise from nothing, so it’s all about persevering.

On the flip side, what’s overwhelmingly lacking is angel investors with literacy in this field. Although our association has only been established for a few months, I sense that many are still feeling their way through communication and collaboration with angel investors. We receive numerous inquiries from the government as well.

Silicon Valley became the epicenter of startups because of its solid layer of angel investors. Therefore, we will continue to focus on nurturing angel investors to maintain that ecosystem.

The venue was filled with enthusiasm.

The Japan Angel Investors Association is currently seeking “Angel Members” for angel investors and “Partner Members” for local governments, companies, and organizations supporting startups.

Membership is free of charge. Why not join us in supporting the growth of startups together?

More details are available here →https://j-angel.jp/

Speaker and Stakeholder Group Photo

Panel Discussion 1: Angel Investing

・Mr. Yoshiaki Ishii (Cabinet Office Official, Ministry of Economy, Trade and Industry / Committee Member, Fund Division, Independent Administrative Institution Small and Medium Enterprise Agency)

・Mr. Shuji Honjo (Representative, Honjo Office)

・Ms. Chikako Morimoto (Representative Director, Morich Co., Ltd. / AllRounderAgent)

・Mr. Toshiyuki Yamamoto (Founder of Chatwork / Representative Director of Japan Angel Investors Association / CEO of Power Angels)

Panel Discussion 2 – Venture Capital:

– Mr. Tohru Yamaguchi (Managing Partner, Abies Ventures)

– Ms. Eriko Suzuki (President and CEO, Kind Capital)

– Ms. Tomoko Inoue (President and CEO, Omron Ventures)

– Mr. Tomosaku Munehara (Managing Partner, NordicNinja VC)

Speech by a Venture Capitalist from Taiwan:

– Ms. Satomi Endo (Co-Leader, Asia Pacific Business Development, BE Health Ventures)

Special Dialogue:

– Mr. Mitsuru Izumo (President and CEO, Euglena Co., Ltd.)

– Mr. John Kojiro Moriwaka (Director, Startup Grind Tokyo)

Speech by a Global Venture Capitalist:

– Mr. Toshitada Nagumo (CEO, Pegasus Tech Ventures Japan)

Panel Discussion 1: Angel Investing

・Mr. Yoshiaki Ishii (Cabinet Office Official, Ministry of Economy, Trade and Industry / Committee Member, Fund Division, Independent Administrative Institution Small and Medium Enterprise Agency)

・Mr. Shuji Honjo (Representative, Honjo Office)

・Ms. Chikako Morimoto (Representative Director, Morich Co., Ltd. / AllRounderAgent)

・Mr. Toshiyuki Yamamoto (Founder of Chatwork / Representative Director of Japan Angel Investors Association / CEO of Power Angels)

Panel Discussion 2 – Venture Capital:

– Mr. Tohru Yamaguchi (Managing Partner, Abies Ventures)

– Ms. Eriko Suzuki (President and CEO, Kind Capital)

– Ms. Tomoko Inoue (President and CEO, Omron Ventures)

– Mr. Tomosaku Munehara (Managing Partner, NordicNinja VC)

Speech by a Venture Capitalist from Taiwan:

– Ms. Satomi Endo (Co-Leader, Asia Pacific Business Development, BE Health Ventures)

Special Dialogue:

– Mr. Mitsuru Izumo (President and CEO, Euglena Co., Ltd.)

– Mr. John Kojiro Moriwaka (Director, Startup Grind Tokyo)

Speech by a Global Venture Capitalist:

– Mr. Toshitada Nagumo (CEO, Pegasus Tech Ventures Japan)