2025.5.16

Column

Our association works to enhance Japan’s angel investment environment, supporting startup growth by regularly sharing activity reports, news, and pitch event insights related to angel investing.

In November 2022, Japan launched the “Five-Year Startup Development Plan” to build an ecosystem conducive to startups. However, despite the startup boom, significant market growth remains elusive. This article presents the vision of TOSHI Yamamoto, director of our association, regarding the future of the TSE Growth Market.

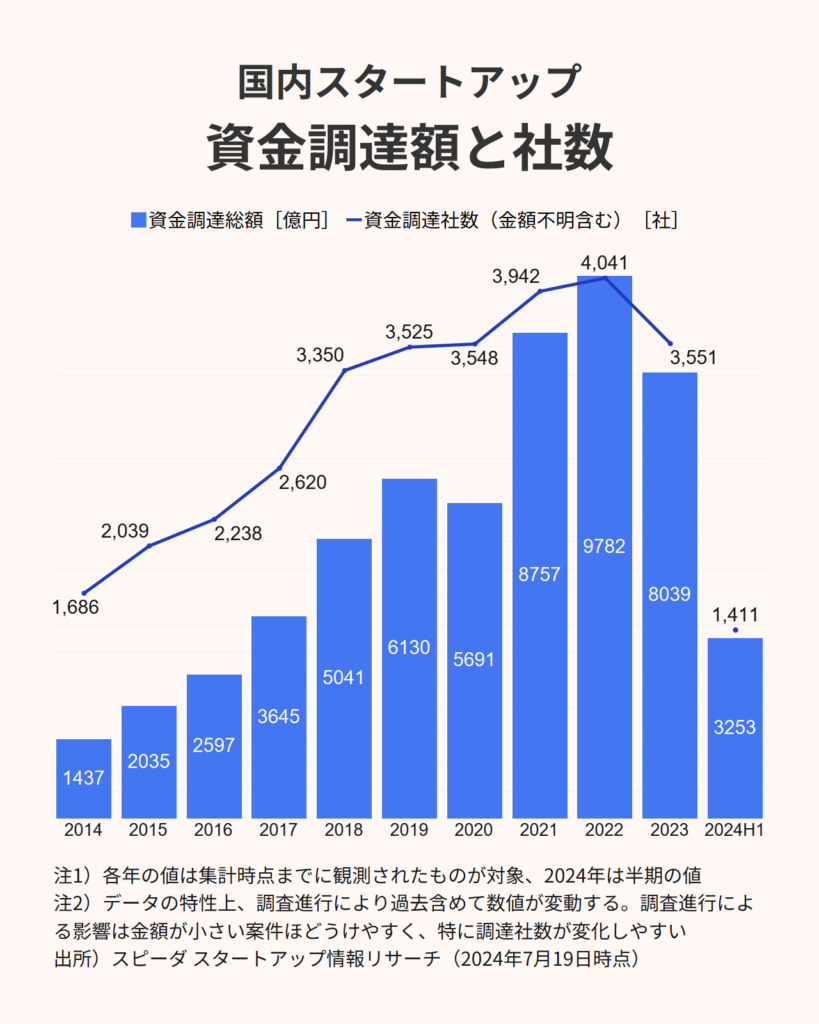

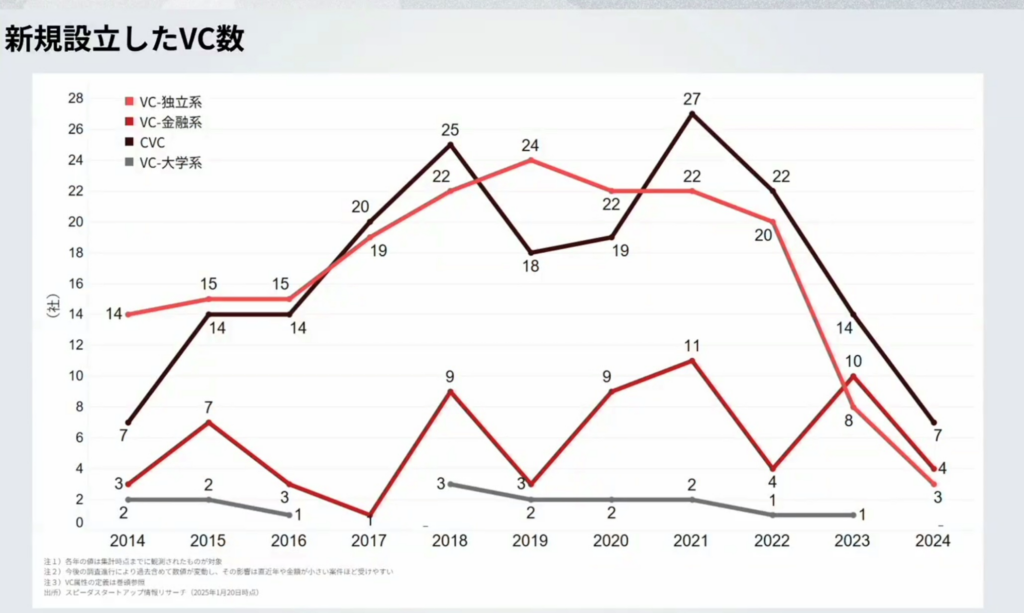

The Japanese government’s “Five-Year Startup Creation Plan” aims to create 100,000 startups, expand investment by 10 trillion yen, and nurture 100 unicorn companies between 2022 and 2027. Yet, investment levels have been declining annually, and unicorn creation is limited to roughly one per year, making these targets challenging to achieve. Startup Funding Amounts Startup funding peaked in 2022. Number of New VCs Established The number of newly established VC firms has drastically declined.

Startup Funding Amounts Startup funding peaked in 2022.

Number of New VCs Established The number of newly established VC firms has drastically declined.

The primary objective of the Tokyo Stock Exchange’s (TSE) Growth Market is to support sustained corporate growth. However, most companies experience declining stock prices post-listing, hindering further fundraising opportunities. This results in reduced investor returns and diminished enthusiasm, creating a negative cycle. Moreover, the Growth Market predominantly attracts short-term individual investors, with limited participation from institutional and foreign investors. Without change, Japan risks limiting unicorn births, impeding market vitality, and negatively impacting overall economic growth.

Stock Performance on the TSE Growth Market (Last 5 Years)

While the TSE Growth Market is considering tightening the market capitalization standard to 10 billion yen, merely raising listing criteria won’t fundamentally solve existing problems.

Although the government has effectively supported startups pre-IPO, improvements are urgently needed in the post-IPO environment, particularly addressing the prevalence of short-term trading by individual investors.

To progressively expand market scale, we propose three strategic measures:

1.To progressively expand market scale, we propose three strategic measures. Attracting Institutional and Foreign Investors

The government should explicitly aim to invigorate the TSE Growth Market, creating government-affiliated funds to support sustainable market growth. Specifically, encouraging the Development Bank of Japan (DBJ) and Government Pension Investment Fund (GPIF) to invest in the TSE Growth 250 Index can stabilize the market and lift share prices. For example, allocating just 1% of GPIF’s roughly 260 trillion yen assets to the Growth Market could increase its total market capitalization (currently around 8 trillion yen) by 20-30%. This would enhance liquidity and attract further institutional and foreign investor participation.

2.Encouraging Individual Investors to Shift from Short-Term to Long-Term Investments

With the new NISA scheme boosting investment over savings, 10.4 trillion yen of the 17.45 trillion yen invested in 2024 will likely flow into overseas assets.

Introducing a “Special Growth Allocation” by expanding the current growth investment limit from 2.4 million yen to 4.8 million yen is recommended. Additionally, permitting reinvestment of funds sold within the same year, along with incorporating the TSE Growth 250 Index into regular investment frameworks such as NISA, iDeCo, and corporate DC plans, could ensure stable, long-term capital inflows. Redirecting just 20% of the overseas outflow could boost market capitalization by approximately 20%.

3.Supporting Post-Listing Growth Strategies

Currently, companies listed on the TSE Growth Market cannot undertake new projects for two years pre-listing, limiting their post-listing strategic preparedness and fundraising capabilities. To address this, establishing subsidies to facilitate M&A activities targeting SMEs facing succession challenges is crucial.

This would allow recently listed companies to swiftly implement new business strategies, simultaneously solving Japan’s SME succession crisis.

Activating the TSE Growth Market would enable entrepreneurs smoother fundraising and investors to achieve stable returns, fostering a virtuous cycle for sustained economic growth in Japan:

1. Entrepreneurs secure favorable financing, enabling ambitious challenges.

2. Investors gain significant returns, forming larger investment funds.

3. Large-scale investments cultivate unicorns, positioning them as future GAFAM candidates.

4. Companies achieve higher market valuations upon listing, securing ample funding.

5. Increased market entry by institutional and foreign investors.

6. Individual NISA investors realize steady returns.

7. More companies upgrade to the Prime Market.

8. Enhanced overall Japanese economic vitality, driving further growth.

These proposals reflect TOSHI Yamamoto’s vision for accelerating the growth of the TSE Growth Market.